Reduce mortgage term calculator

If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest. Moreover it allows you to shift from a fixed-rate mortgage to.

Loan Interest Calculation Reducing Balance Vs Flat Interest Rate Loan Calculation Calculator Method Inte Intrest Rate Interest Calculator Finance Guide

The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments.

. Extend the term the number of years it will take to pay off the loan. The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments. Making an overpayment will reduce the amount of interest you are charged.

You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Try to avoid PMI private mortgage insurance if you can.

In the More Options input section of the calculator is an Extra Payments section to input. In Quebec call 1-800-813-1833. Likewise if you keep making extra monthly mortgage payments this will further reduce your term and interest charges.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. Make a larger down payment to get a lower payment. Our calculator is for demonstration only and should not be relied upon as an absolute figure.

This is the purchase price minus your down payment. The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments. Extend the term the number of years it will take to pay off the loan.

Longer-term lengths will reduce your monthly payment but youll pay more interest over time. Or view two different loan amounts that carry the same interest rate and repayment period. How to estimate mortgage payments.

How much can I borrow. The most common mortgage term in Canada is five years while the most common amortization period. Just like the name says you only pay the interest on the loan rather than the principle.

Making prepayments can potentially shorten the loan term and reduce the interest payments. Our mortgage overpayment calculator uses the standard. Offset calculator see how much you could save.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. The mortgage amortization period is how long it will take you to pay off your mortgage. If you make higher overpayments you can further shorten your loan term and reduce your interest costs.

Refer to your mortgage documents to find the information you need for this calculator. Choose a longer-term mortgage like a 30-year rather than a 15-year loan. A mortgage calculator can help you decide whether you should.

To decide what the best loan term is Mortgages are commonly offered with either 15 or 30-year terms. Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows. Consider this example if you want to maximise your savings.

Improve your credit score. Comparing loan features side by side helps you find the mortgage loan you need. The above calculator supports recurring weekly biweekly monthly quarterly or annual payments along with one-off lump sum contributions.

For details about your mortgage sign on to CIBC Online Banking or call us at 1-888-264-6843. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. Term and Interest rate.

Principal Years Start month Start year Interest o oo ooo 18 Payment Year Year Summary. This mortgage comparison calculator compares loans with different mortgage rates loan amounts or terms. Buy a home in a neighborhood with expensive HOA fees.

As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. The calculator assumes that your monthly overpayments will be the same every month for the rest of the mortgage term. Use this large fund to shorten your mortgage term and diminish your interest costs.

Choose a term and interest rate that best suits your needs and your timeline. If your mortgage term is longer than 5 years the calculator estimates apply only during the first 5 years of that term. Based on a 200000 mortgage at a fixed 3 APR you can save over 5000 if you make an overpayment of 50 per month.

Free VA mortgage calculator to find the monthly payment total interest funding fee and amortization details of a VA loan or to learn more about VA loans. As a result you lower your payment as much as you possibly can. Affordability calculator get a more accurate estimate of how much you could borrow from us.

Buy in an area with high property taxes. Interest-only loans offer a flexible financing option for those who need to reduce their monthly mortgage payment. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for.

Depending on the price of your home a mortgage calculator can help you figure out what the best down payment will be. Make a larger down payment to reduce your monthly PMI amount. It takes about five to ten minutes.

Put 20 down or as much as you can for your down payment. Choose a shorter term to pay off your loan faster. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out.

Making Extra Mortgage Payments on an Interest-Only Loan. Compare two fixed rate loans with different rates repayment periods. It will also remove more than 1 year off a 25-year mortgage term.

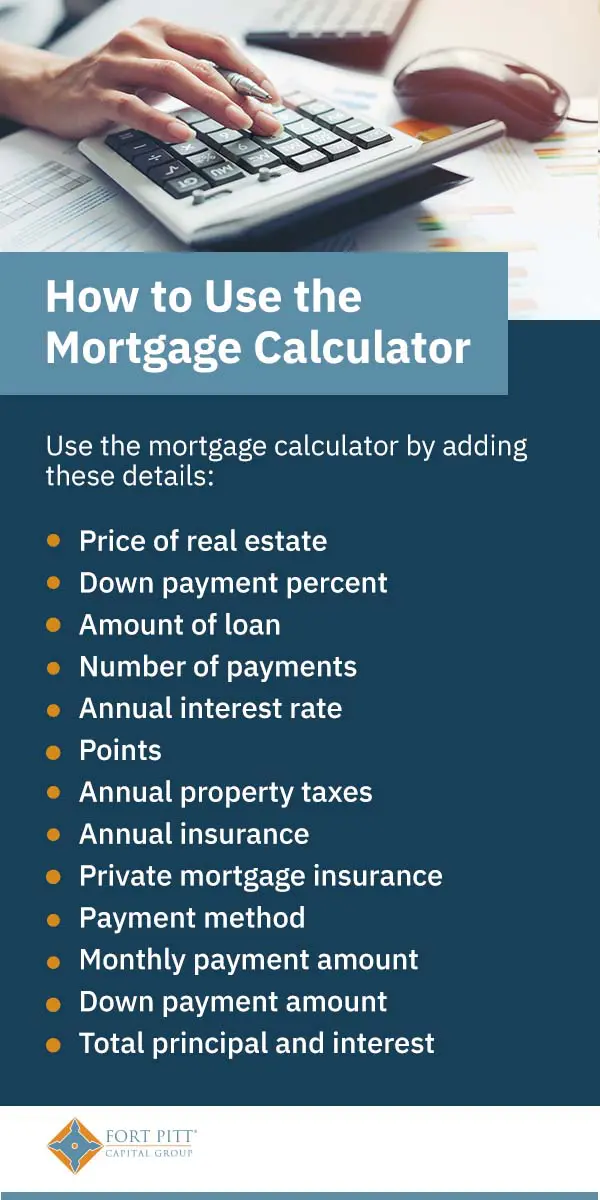

Mortgage Calculator With Down Payment Dates And Points

Mortgage Calculations Using Ba Ii Plus Youtube

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

Online Mortgage Calculator Wolfram Alpha

Extra Payment Mortgage Calculator For Excel

Mortgage Overpayment Calculator Uk Usa Canada Mortgage Repayment Calculator Mortgage Personal Finance Blogs

Best 10 Mortgage Calculator Apps Last Updated September 19 2022

Downloadable Free Mortgage Calculator Tool

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Comparison Mortgage Loan Calculator Mortgage Estimator

Flat Interest Rate Vs Reducing Balance Rate Types Of Loans Interest Rates Interest Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator Estimate Your Monthly Payments

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Mortgage Calculator Amortization Schedule Mortgage Rates